Renters Insurance in and around Graham

Get renters insurance in Graham

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

It may feel like a lot to think through work, your sand volleyball league, your busy schedule, as well as coverage options and deductibles for renters insurance. State Farm offers straightforward assistance and remarkable coverage for your appliances, mementos and sound equipment in your rented condo. When trouble knocks on your door, State Farm can help.

Get renters insurance in Graham

Coverage for what's yours, in your rented home

Safeguard Your Personal Assets

Renters insurance may seem like not a big deal, and you're wondering if you really need it. But pause for a minute to think about the cost of replacing all the stuff in your rented apartment. State Farm's Renters insurance can help when fires or break-ins damage your personal property.

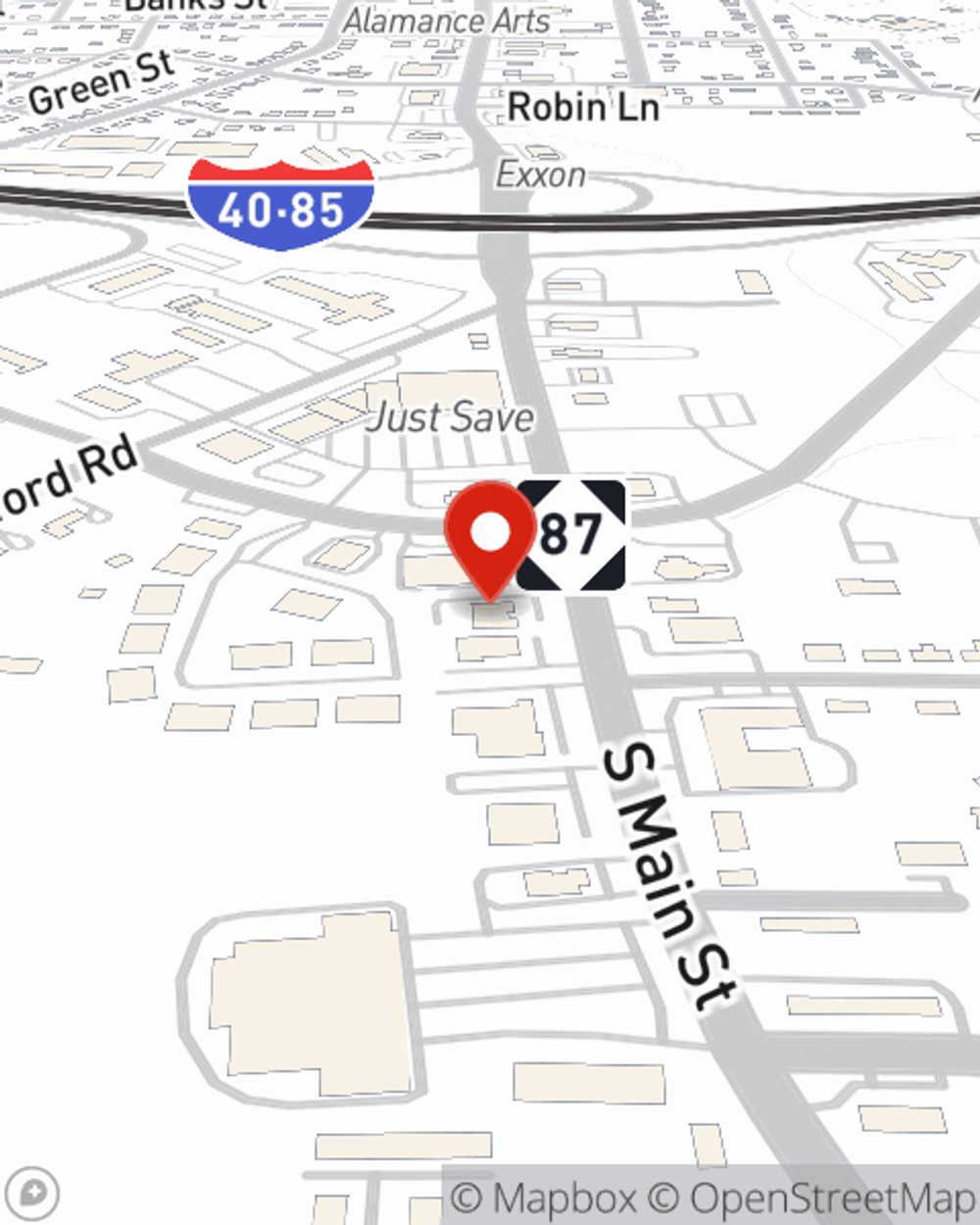

If you're looking for a value-driven provider that can help with all your renters insurance needs, call or email State Farm agent Mike Shoffner today.

Have More Questions About Renters Insurance?

Call Mike at (336) 570-0416 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Mike Shoffner

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.